Procedures for Exporting Goods from Indonesia to Overseas – The activity of exporting goods is a trading system that allows a person to trade across countries. Currently the government is trying to increase foreign exchange by boosting the flow of goods exports.

Export is one of the components of international trade. Another component is imports. They are goods and services purchased by residents of a country that are produced overseas. When combined, they make up a country’s trade balance. When a country exports more than it imports, it has a trade surplus. If imports are more than exports, it will run a trade deficit.

In Indonesia, export activities have increased. The Central Statistics Agency (BPS) noted that Indonesia’s export value in February 2021 was US $ 15.27 billion. Thus, the export value in that month increased by 8.56% year on year (yoy).

Head of BPS, said that this is an exciting thing. This is because the export performance since November 2020 has continued to experience positive growth (yoy).

The export value in February 2021 was also greater than the export value in February 2020 which at that time was recorded at US $ 14.06 billion and better than February 2019 which at that time was valued at US $ 12.79 billion.

This is a very encouraging development, and it is hoped that future exports will be even better. This annual increase occurred due to an increase in oil and gas exports (oil and gas) by 6.90% (yoy) and exports on a non-oil and gas basis, which rose 8.67% (yoy).

Below is the Export Abstraction Data from the Central Bureau of Statistics Website

1. Indonesia’s export value in January 2021 reached US $ 15.30 billion or decreased by 7.48 percent compared to exports in December 2020. Meanwhile, compared to January 2020, it increased by 12.24 percent.

2. Non-oil and gas exports in January 2021 reached US $ 14.42 billion, down 7.11 percent compared to December 2020. Compared to non-oil and gas exports in January 2020, it was up 12.49 percent.

3. The largest decline in non-oil and gas exports in January 2021 against December 2020 occurred in metal ore, slag and ash amounting to US $ 257.5 million (44.39 percent), while the largest increase occurred in mineral fuels amounting to US $ 150.5 million (8.72 percent).

4. According to the sector, non-oil and gas exports from the processing industry in January 2021 rose 11.72 percent compared to the same month in 2020, likewise the export of agricultural products increased by 13.91 percent and exports of mining products and others rose 16.92 percent.

5. The largest non-oil and gas exports in January 2021 were to China, namely US $ 3.05 billion, followed by the United States at US $ 1.68 billion and Japan with US $ 1.25 billion, with the contribution to ganya reaching 41.45 percent. Meanwhile, exports to ASEAN and the European Union (27 countries) amounted to US $ 3.05 billion and US $ 1.17 billion, respectively.

6. According to the province of origin, Indonesia’s largest exports in January 2021 came from West Java with a value of US $ 2.56 billion (16.72 percent), followed by Riau with US $ 1.53 billion (9.99 percent) and East Java with US $ 1.51 billion. (9.88 percent).

Advantages of Exporting

Access to more Consumers and Businesses

If you only run an in-house business, you may be limiting the total potential profit you can get from the opportunity to grow your business around the world. Acquiring new opportunities to expand your business in markets around the world can help you increase your market inclination in doing business and get closer to consumers.

Extending the Product Life Cycle

Increased Domestic Competitiveness Most companies become competitive in the domestic market before they venture into the international shutter. Being competitive in the domestic market helps companies come up with several strategies that can assist in introducing their products. If the domestic market seems saturated for your goods and services, you can introduce them to new markets in other parts of the world. Introducing unknown products in other parts of the world is a way of approaching consumers in doing business.

Get Global Market Share

Being an international company will participate in the global market and get a share of their share of the huge international market.

Diversification

Selling to multiple markets allows companies to diversify their business and spread the risk. The company will not be bound by changes in the business cycle of the domestic market or one particular country.

Offsetting Seasonal Demand

Companies whose products or services are used only during certain seasons of the country may be able to sell their products or services in foreign markets during different seasons.

Create Potential for Company Expansion

Companies that enter the export business usually need to have a presence or representation in foreign markets. This may require additional personnel and thus lead to expansion.

Get New Knowledge and Experience

Being an international company can generate valuable ideas and information about new technologies, new marketing techniques, and foreign competitors. These advantages can help a company’s domestic and foreign businesses.

Increase Sales and Profits

Selling goods and services to markets that the company has never owned before increases sales and increases revenue. Additional overseas sales in the long run, once export development costs are closed, increase overall profitability. Bigger production can result in bigger economies of scale and better margins.

Procedure for Exporting Goods from Indonesia to Overseas

Export is an activity of releasing goods from the Indonesian customs area to the customs area of another country. Usually the export process starts with an offer from a party accompanied by approval from another party through a sales contract process, in this case the Exporters and Importers. The payment process for this transfer can be via the Letter of Credit (L/C) or non-L/C methods, each of which has its own risks and advantages.

Indonesia and Free Trade

Indonesia is a member of the Association of Southeast Asian Nations (ASEAN) which is currently developing the ASEAN Free Trade Area (AFTA) policy which seeks to reduce intra-regional tariffs among its members through the Common Effective Preferential Tariff (CEPT) Scheme. This rate requires its members to apply a rate of 0-5%.

More than 99% of the products on the CEPT Inclusion List (IL) of ASEAN-6, which consists of countries such as Brunei Darussalam, Indonesia, Malaysia, the Philippines, Singapore and Thailand have applied tariffs of 0-5%, while other countries such as Cambodia , Laos, Myanmar and Vietnam are still in the development stage of implementing these tariffs.

Currently, Indonesia also not only develops free market policies among ASEAN members but has now developed cooperation with other countries as well as through:

1. ASEAN-Australia-New Zealand, learn more: http://ditjenkpi.kemendag.go.id/index.php?module=aseanausnz or http://aanzfta.asean.org/

2. ASEAN-Cina, learn more: http://ditjenkpi.kemendag.go.id/index.php?module=indonesiachina or http://www.asean-cn.org

3. ASEAN-Korea, learn more: http://ditjenkpi.kemendag.go.id/index.php?module=aseankorea, http://www.akfta.net/ or http://www.aseankorea.org/

4. ASEAN-India, learn more: http://ditjenkpi.kemendag.go.id/index.php?module=aseanindia

5. Indonesia-Jepang (IJ-EPA), learn more: http://ditjenkpi.kemendag.go.id/index.php?module=ijepa

6. And other bilateral cooperation whose information can be accessed at http://ditjenkpi.kemendag.go.id/index.php?module=PKEKI

Export Step

The steps for exporting goods in Indonesia, containing a flow chart of export activities, starting from licensing, ordering, shipping, and payment.

Requirements to Become an Exporter

To become an export company must meet the following conditions:

1. Legal entity, in the form of:

+ CV (Commanditaire Vennotschap)

+ Firm

+ PT (Limited Liability Company)

+ Persero (Limited Liability Company)

+ Perum (Public Company)

+ Perjan (Service Company)

+ Cooperative

2. Have an NPWP (Taxpayer Number)

3. Has one of the permits issued by the government, such as:

+ Trading Business License (SIUP) from the Trade Office

+ Industrial Permit from the Industry Service

+ Domestic Investment Business License (PMDN) or Foreign Investment (PMA) issued by the Investment Coordinating Board (BKPM)

These exporters can be classified into:

a) Producer Exporters, with the following conditions:

-

-

-

- As an Exporters Producers in an effort to obtain legality should meet the stipulated requirements, namely filling out a form provided by the Industry and Trade Agency at the Regency/City or Provincial Government, and related technical agencies.

- Have an industrial business license.

- Have a NPWP.

- Providing reports on the realization of exports to the Office of Industry and Trade or appointed agencies and officials (periodically every three months) which are validated by the Foreign Exchange Bank by attaching a statement letter such as: not involved in tax arrears, not involved in banking arrears, not involved in customs issues.

-

-

b) Non-Producer Exporters, with the following conditions:

-

-

-

- As a non-producer exporter, to obtain legality, should fulfill the stipulated requirements, namely filling out the form provided by the Industry and Trade Service in the Regency/City or Provincial Government and related technical agencies.

- Have a Trading Business License.

- Have a NPWP.

- Providing reports on the realization of exports to the Office of Industry and Trade or appointed agencies/officials (every three months) authorized by the Foreign Exchange Bank by attaching a statement such as not involved in tax arrears, not involved in banking arrears, not involved in customs issues.

-

-

Four Main Stages In Export (Using L/C)

1. Sales Contract Process

Sales contract is a document/agreement letter between the seller and the buyer which is a follow-up of the purchase order requested by the importer. It contains the terms of payment for goods to be sold, such as price, quality, quantity, transportation method, insurance payment and so on. This contract is the basis for the buyer to fill out an L/C opening application to the Bank.

a) Promotion

Promotional activities for commodities that will be exported through promotional media such as advertisements in electronic media, magazines, newspapers, trade shows or through agencies/institutions related to export promotion activities such as the Directorate General of National Export Development, Chamber of Commerce and Industry, Trade Attaches and so on.

b) Inquiry

Delivery of a letter of request for a certain commodity by the importer to the exporter (letter of inquiry). Usually contains a description of the goods, quality, price and delivery time.

c) Offer Sheet

The importer’s request will be responded to through an offer sheet sent by the exporter. This offer sheet contains information according to the importer’s request regarding the description of the goods, quality, price and delivery time. Apart from that, this offer sheet usually adds the terms of payment and delivery of samples/brochures.

d) Order Sheet

After getting an offer from the exporter and studying it, if agreed, the importer will send a letter of order in the form of an order sheet (purchase order) to the exporter.

e) Sale’s Contract

In accordance with the data from the order sheet, the exporter will then prepare a sale contract which is added with a description of the force majeure clause and inspection clause. This sales contract is signed by the exporter and sent in two copies to the importer.

f) Sale’s Confirmation

The sales contract will be studied by the importer, if the importer agrees, the importer will sign the sales contract and then return it to the exporter as a sales confirmation. Meanwhile, another copy of this sales contract will be kept by the Importer.

2. L/C Opening Process

Letter of credit (L/C) is a guarantee from the issuing bank to the exporter in accordance with the importer’s instructions to pay a certain amount for a certain period of time based on the submission of documents requested by the importer.

The process for opening the L/C is as follows:

-

- The importer will ask the Opening Bank (Foreign Exchange Bank) to open a Letter of Credit as collateral and the funds will be used to make payments to the Exporter according to the agreement on the sales contract. The L/C opened is for and on behalf of the exporter or other person or entity appointed by the exporter in accordance with the payment terms in the sales contract.

- The opening bank will open an L/C through its correspondent bank in the exporting country, in this case an advising bank. This L/C opening process is carried out through electronic media, while the written confirmation will be stated in an L/C confirmation which is forwarded from the opening Bank to the advising Bank to be submitted to the Exporter.

- The Advising Bank will check the validity of the opening of the L/C from the opening Bank, and if appropriate, the advising Bank will send a letter of introduction (L/C advice) to the eligible Exporter. If the advising Bank is also requested by the opening Bank to guarantee payment of the said L/C, the advising Bank is also called a confirming Bank.

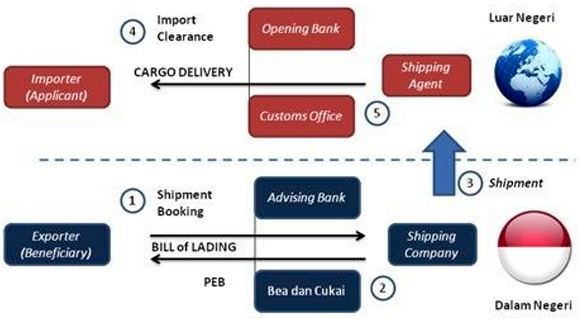

3. Cargo Shipment Process

The important output of this process is a shipping document which is proof that the exporter has sent the goods ordered by the Importer in accordance with the requirements stated in the L/C.

The stages of cargo shipment process are as follows:

-

- The exporter will receive L/C advice as a reference for delivering the goods and at this time the exporter will make a shipment order to the shipping company according to the terms stated in the sales contract. After that the exporter must take care of the obligations of the Export Declaration of Goods (PEB) at Customs and Excise at the port of loading. As well as other things such as the payment of export tax (PE) and Additional Export Tax (PET) on the advising Bank.

- Shipping Company will load the goods and submit proof of receipt of goods, contract of transport, proof of ownership of goods (bill of lading) and other shipping documents if any to the exporter, then the exporter will send it to the advising bank to be sent to the opening bank.

- Shipping Company will transport the goods to the destination port stated in the Bill of Lading (B/L).

- The importer will receive the shipping document if the payment obligation to the opening bank has been made. Furthermore, this shipping document is used to take care of import clearance with customs at the port and to pick up cargo from the shipping company containing the goods ordered.

- The Shipping Agent will deliver the goods to the Importer if the shipping agent service fee has been paid.

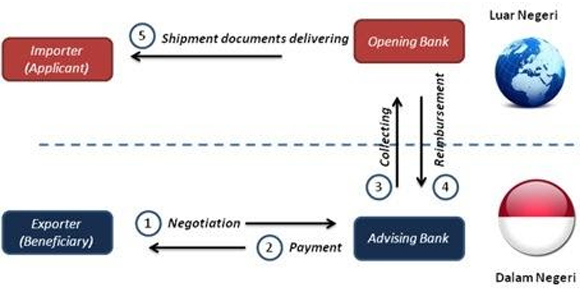

4. Shipping Document Negotiation Process

This process is the process of cashing out shipping documents for exporters and is a process for claiming goods that have been paid for importers.

-

- After receiving the B/L from the shipping company, the Exporter will prepare all other documents required by the L/C such as invoice, packing list, quality certification, Certificate of Origin (SKA) and so on. All documents will be submitted to the negotiating bank, in this case the advising bank, which is specified in the L/C to obtain payment for the L/C.

- The Negotiating Bank will check the completeness and accuracy of the shipping documents sent by the exporter, if it matches the required L/C, the negotiating Bank will make payments according to the exporter’s bill from the available L/C funds.

- The Negotiating Bank will send the shipping document to the opening Bank to get reimbursement for the payment it has made to the Exporter

- The Opening Bank will check the completeness and accuracy of the shipping documents, if it matches the L/C required, the opening Bank will provide a reimbursement to the negotiating Bank.

- The Opening Bank then notifies the importer of receipt of shipping documents. The importer will complete the payment of the document to obtain a shipping document which functions to collect the ordered goods from the shipping agent and local customs

Large Flowchart of Export Activities

To learn more about the exporting goods from Indonesia procedure, the following is a large flowchart of export activities:

Payment method

Several payment methods that can be used in the export-import process are as follows;

Swipe Table >>

| Metode | Deskripsi | |||

|---|---|---|---|---|

| Eksportir | Importir | |||

| Advance Payment | Cash with order, pembayaran langsung kepada eksportir sebelum barang yang dipesan dikirim | Menarik bagi Eksportir karena menerima pembayaran terlebih dahulu | - Resiko gagal atau terlambatnya pengiriman barang - Resiko kualitas dan jumlah barang yang tidak sesuai |

|

| Open Account | Barang dikirim terlebih dahulu oleh eksportir dan pembayaran dilakukan setelah importir menerima barang tersebut | Resiko terlambat pembayaran atau tidak dibayar | Menarik bagi Importir karena menerima barang terlebih dahulu |

|

| Consignment | Pengiriman barang kepada perantara (importir) yang akan menjual barang tersebut kepada final buyer, kepemilikan barang tetap milik eksportir sampai barang tersebut terjual | Kemungkinan gagal pembayaran atau pembayaran terlambat, karena barang belum tentu terjual | Menguntungkan Importir karena dapat menjual barang tanpa membayar terlebih dahulu |

|

| Collection | Document againts payment (D/P) | Eksportir mengirimkan barang ke port tujuan sedangkan dokumen pengiriman barang dikirimkan ke pihak Bank sebagai perantara. Importir dapat mengambil dokumen tersebut jika sudah melakukan pembayaran melalui Bank, dokumen ini diperlukan importir untuk mengambil barang di port | Tidak ada jaminan pembayaran dari Bank kepada Eksportir, karena Bank hanya berperan sebatas pelayanan jasa saja | Terdapat resiko barang yang dikirimkan tidak sesuai dengan permintaan |

| Document againts acceptance (D/A) | Hampir sama dengan Document againts payment, perbedaannya adalah metode ini memerlukan akseptasi pembayaran terlebih dahulu oleh importir agar importir dapat menerima dokumen pembayaran dari Bank. Akseptasi pembayaran ini merupakan janji pembayaran pada tanggal tertentu, biasanya 30, 60 atau 90 hari setelah akseptasi | Tidak ada jaminan pembayaran dari Bank kepada Eksportir, karena Bank hanya berperan sebatas pelayanan jasa saja | Terdapat resiko barang yang dikirimkan tidak sesuai dengan permintaan |

|

| Letter of Credit (L/C) | Jaminan yang diterbitkan oleh issuing Bank atas perintah applicant (Buyer) kepada eksportir agar Importir melakukan pembayaran sejumlah tertentu | Jaminan pembayaran dari Bank selama dokumen yang dikirimkan sesuai dengan L/C | Jaminan memperoleh barang sesuai dengan yang disepakati |

|

Incoterms

Incoterms or International Commercial Terms are terms (a set of three-letter codes) used in international trade to regulate so that there is no misinterpretation in making contracts, this Incoterm regulates the conditions that must be met in delivery or delivery of goods.

Swipe Table on Mobile >>

| E | EXW | Ex Works | Penjual menyerahkan barang yang belum mendapat izin ekspor di kediamannya atau di tempat lain yang ditentukan (sebutkan nama tempat) |

| F | FCA | Free Carrier | Penjual menyerahkan barang yang sudah mendapat izin ekspor kepada pengangkut yang ditunjuk pembeli di tempat tujuan (sebutkan nama tempat) |

| FAS | Free Alongside Ship | Penjual menyerahkan barang yang sudah mendapat izin ekspor di samping kapal di pelabuhan tujuan (sebutkan nama pelabuhan pengapalan) |

|

| FOB | Free on Board | Penjual menyerahkan barang melewati pagar kapal di pelabuhan pengapalan yang disebut, barang sudah clear for export (sebutkan nama pelabuhan pengapalan) |

|

| C | CFR | Cost and Freight | Penjual menyerahkan barang melewati pagar kapal di pelabuhan pengapalan yang disebut, barang sudah clear for export dan biaya angkut ke pelabuhan tujuan sudah ditanggung penjual (sebutkan nama pelabuhan tujuan) |

| CIF | Cost, Insurance and Freight | Sama dengan CFR tetapi penjual me- nanggung asuransi dan membayar premi (sebutkan nama pelabuhan tujuan) |

|

| CPT | Carriage Paid To | Mirip dengan CFR tapi barang diangkut ke tempat tujuan tertentu (sebutkan nama tempat tujuan) |

|

| CIP | Carriage and Insurance Paid to | Hampir sama dengan CPT tetapi penjual menutup asuransi terhadap risiko kerusakan selama perjalanan (sebutkan nama tempat tujuan) |

|

| D | DAF | Delivered At Frontier | Penjual menyerahkan barang di tempat pada wilayah perbatasan tetapi belum memasuki wilayah pabean negara yang dituju (sebutkan nama tujuan) |

| DES | Delivered at Ship | Penjual menyerahkan barang di tempat pada wilayah perbatasan tetapi belum memasuki wilayah pabean negara yang dituju (sebutkan nama tujuan) |

|

| DEQ | Delivered Ex Quay | Penjual menyerahkan barang kepada pembeli di atas kapal, penjual menanggung risiko dan biaya sampai sesaat sebelum dibongkar (sebutkan nama pelabuhan tujuan) |

|

| DDU | Delivered Duty Unpaid | Penjual menyerahkan barang kepada pembeli di atas dermaga pelabuhan tujuan, uncleared for import (sebutkan nama pelabuhan tujuan) |

|

| DDP | Delivered Duty Paid | Sama dengan DDU tetapi formalitas impor sudah diurus |

Intellectual Property Rights

Intellectual property rights (IPR) are divided into two categories, namely copyrights and industrial property rights. Copyright is an exclusive right for an author or the right recipient to publish or reproduce his work or give permission for it without reducing the restrictions according to the prevailing laws and regulations.

Meanwhile, industrial property rights consist of the rights:

-

- Patent

- Brand

- Industrial design

- Integrated circuit layout design

- Trade secret

- Plant varieties

In Indonesia, the appreciation of intellectual property rights is still low, so that sometimes there are those who think that these intellectual property rights are not needed. In fact, intellectual property rights are useful for protecting entrepreneurs from the possibility of using their property rights without permission. Therefore it is important for exporters to prepare their products related to IPR before exporting so that these products have legal protection.

As a consequence of membership of the World Trade Organization (WTO), Indonesia must adjust all laws and regulations in the field of Intellectual Property Rights with Trade Related Aspects of Intellectual Property Rights (TRIP’s) standards. One proof that Indonesia pays serious attention to protecting IPRs, Indonesia has an agency that is authorized to manage Intellectual Property Rights, namely the Directorate General of Intellectual Property Rights (Ditjen HKI) which is under the Ministry of Justice and Human Rights of the Republic of Indonesia.

The registration mechanism and further explanation can be seen at http://www.dgip.go.id/. IPR applicants can see on the website of the Directorate General of IPR whether their products have been registered or not, and IPR applicants can also conduct searches to other patent offices in the destination country.

Export Licensing and Customs

Tax Procedure

If the exported goods are subject to export tax, the export tax must be paid before being put into the transportation means. This export tax is calculated based on the export benchmark price (HPE) and this export benchmark price is determined by the Minister of Trade in the form of a Minister of Trade regulation that is valid for a certain period by taking into account the considerations of the Technical Minister and related associations. This HPE is guided by the international average price and / or the average FOB price price in several ports in Indonesia.

The export levy rate (TPE) which is used as the basis for calculation is the TPE which applies when the notification of export of goods (PEB) is registered at the Customs and Excise Service Office, as well as the HPE, the HPE used is the HPE that applies when the PEB is registered at the Service Office. Customs and Excises.

How to calculate export tax

1. For export goods subject to ad valorem tariff (percentage), Export Tax is calculated as follows:

Export Tax = Export Tax Rate x Standard Export Price x Quantity of Goods x Exchange Rate

2. For export goods subject to ad naturam (specific) tariffs, the Export Tax is calculated as follows:

Export Tax = Export Tax Rate x Quantity of Goods x Exchange Rate

Payment of export levies can be made at the Foreign Exchange Bank or at the Customs and Excise Service Office:

Commodities Subject to Export Levies

1. Rattan, consisting of:

+ Original rattan that has been stringed, washed, smoked and dyed of all kinds;

+ Fine polished rattan;

+ Rattan heart; and

+ Rattan bark

2. Wood, consisting of:

+ Veener

+ Flakes raw material

+ Processed wood

3. Palm oil, CPO and their derivative products consist of:

+ Oil palm / fresh fruit bunches and oil palm kernel (seeds) and;

+ Crude palm oil / CPO (crude olein / CRD; Refined bleached deodorized palm oil / RBD PO; Refined bleached deodorized palm olein / RBD olein)

4. Skin, consisting of:

+ Hides and skins raw / pickled from cattle / buffalo and sheep and

+ Tanned / wet blue skin from cattle / buffalo, sheep and goats

Customs Licensing Flowchart

Broadly speaking, the customs procedures for the exporting goods from Indonesia are as follows:

1. Goods to be exported must be notified in advance to the customs office by filling out the export notification document (PEB).

2. Registration of PEB is accompanied by a Company Identification Number (NIPER) and complementary documents. PEB is submitted no later than 7 days before the estimated date of export and no later than before the export goods enter the Customs Zone. Customs supplementary documents:

-

-

-

- Invoice and Packing List

- Proof of PNBP Pay (Non-Tax State Revenue)

- Proof of Payment of Export Duty (in case the export goods are subject to Export Duty)

- Documents from related technical agencies (in the event that exported goods are subject to prohibition and / or restriction provisions)

-

-

At Customs Offices that have implemented a customs PDE (Electronic Data Exchange) system, exporters / PPJK (Customs Service Management Entrepreneurs) are required to submit PEB using the Customs PDE system

- Payment of export tax if the exported goods are subject to export tax. The exporter can submit this PEB or be authorized by the PPJK

- Physical inspection of exported goods and document checking

- Approval and loading of exported goods onto transportation means

Export Prohibition

According to the regulation of the Minister of Trade of the Republic of Indonesia Number: 13 / M-DAG / PER / 3/2012 dated March 19, 2012. It is stated that export goods are classified into three groups:

- Export-Free Goods

- Export Restricted Goods

- Export Prohibited Goods

Goods as referred to in Export Restricted Goods and Export Prohibited Goods are stipulated in a Ministerial Regulation

Conclusion

Based on the explanation above. If you experience difficulties and ignorance in processing the export permit (from within the country to overseas, related to the procedures and legal basis in force in Indonesia regarding export goods.

We are Indoservice, a shipping service provider that can assist you in the process of licensing the export of goods for your company to Overseas. With a wide selection of methods and fast delivery that are reliable and experienced, committed to providing the best and fast service to meet your needs.

Contact us now for special offers at +62877-1449-8500 or admin@indoservice.co.id

Important Notice:

This information is obtained from:

http://djpen.kemendag.go.id/app_frontend/

https://nasional.kontan.co.id/news/bps-ekspor-februari-2021-sebesar-us-1527-miliar-naik-856-dari-tahun-lalu and several other sources.

0 Comments